Adopo

Guru

Credit to Peter Swanson of Loose Cannon

https://loosecannon.substack.com/p/supreme-court-upholds-back-door-denials

Since there is discussion about insurance I thought this is relevant. I'm guessing we all have been guilty at one time or another of having out of date something on our boats, be it fire extinguishers that still do indeed work or flares. Milk for sure...but to be serious, better check the fire extinguishers now. I have small hand held ones, and half were out of date, so were the flares.

After eating something that made me very ill as a youth, I religiously check food dates, go look in your refrigerator at all the condiments in particular that could even be years old lol, but these things could be sooo much more important. Is there an industry annual check list? Reminder tool for the marine industry? Airplanes have annuals, we hate those but have to have them if you want to stay current. I'm sure that most "captains" on here have a rolling calendar that fire extinguishers and other items that have expiration dates are to be checked and replenished. Do smoke detectors have expiration dates? Co detectors? Etc...It makes no sense at all that an insurance company could denied a claim because something was out of date that had zero effect on the claim.

The U.S. Supreme Court recently upheld a marine insurance company’s right to have claim disputes decided in states whose laws favor the industry over claimants.

The February 21 ruling should send us running to check the fine print in our policies—and maybe the dates on the our fire extinguishers, too.

The case is about a boatowner whose 70-foot motoryacht Raiders was involved in a collision and went aground near Ft. Lauderdale. Phil Pulley filed a claim for the damage, but his insurance company effectively denied the claim because the boat’s fire suppression system was out of compliance under terms of the policy, even though the claim had nothing to do with fire. There was no fire.

Great Lakes Insurance followed a longstanding practice within the industry by declaring Pulley’s policy “void from it’s inception” for non-compliance, then canceled the policy and refunded his premium payments, which amounted to a lot less than what the claim was worth.

Long story short: Pulley took it to court and lost, appealed and won, then his insurance company took the case to the Supreme Court, where Pulley lost forever.

Insurers invoke “breach of warranty” to deny a claim when there is a concurrent but unrelated failure by a policyholder to adhere to the letter of their contract. Breach of warranty is the legal term. Strictly speaking, the case wasn’t about breach of warranty, however.

Great Lakes Insurance v. Raiders Retreat Realty was about “choice of forum.” That is, whether an insurance company can specify that disputes be adjudicated in a state whose laws support the breach-of-warranty denials and make them stick.

Lawyers for Raiders Retreat argued that the deciding laws should be those of Pennsylvania—the boatowner’s home state—because Pennsylvania has a “strong public policy” of not strictly enforcing insurance warranty clauses in claims disputes.

The insurance claim for this motoryacht went all the way to the Supreme Court.

However, the Supreme Court held that choice-of-forum provisions have long been honored under maritime law and enable insurers to better assess risk. “Choice-of-law provisions therefore can lower the price and expand the availability of marine insurance. In those ways, choice-of-law provisions advance a fundamental purpose of federal maritime law: ‘protection of maritime commerce’,” Justice Brett Kavanaugh wrote for the majority.

Cary Wiener is an admiralty lawyer and senior marine advocate for national risk control at Gallagher, a global insurance company. He praised the ruling for preserving an element of predictability in marine insurance.

“Since maritime insurance policies are often provided with large navigational areas, it is essential for both the insurer and insured to know how the wording of the policy will be interpreted based on a provided forum,” Wiener said. “This is especially true since the policies are not subject to state mandated clauses and because of the transient nature of the insured risk.”

Elephant in the Courtroom

Justice Clarence Thomas wrote a concurring opinion that addressed the elephant in the courtroom—the case of Wilburn Boat Company v. Fireman’s Fund Insurance Company, which lawyers simply refer to as “Wilburn Boat.” Wilburn Boat is a 1955 case which threw out the longstanding recognition of warranty clauses in U.S. Maritime Law. Wilburn Boat has been reviled as a destabilizing influence ever since.

The case involved a houseboat destroyed by fire. Fireman’s Fund refused to pay the claim because the boat was being used to carry passengers for hire in violation of one the policy’s express warranty clauses. The high court ruled that Texas law applied, so the policy could not be voided. Fireman’s was forced to pay out.

Reliance on a choice-of-forum clause has been the insurance industry’s work-around so it could continue to enforce warranty clauses—despite Wilburn Boat—in jurisdictions such as New York.

Justice Thomas used Great Lakes v. Raider as a vehicle to heap his own dose of scorn onto Wilburn Boat.

The decision was so bad, Thomas argued, that the court had been retreating from it in subsequent cases ever since, including the current ruling. “Today’s decision further erodes Wilburn Boat’s foundation, and rightly so. In light of these decisions, it is not clear what, if anything, is left of Wilburn Boat’s rationale,” Thomas wrote.

Greg Singer, a lawyer for the Lochner Law Firm of Annapolis, has argued cases in which these distinctions were important. He observed that New York law appears to have been custom crafted to hand marine insurers their advantage.

“Marine insurance companies turn to New York law because while New York insurance law says that an insurance company can’t void a policy for an unrelated breach of warranty, it has a specific carve-out that says the law doesn’t apply to marine insurance policies,” Singer said.

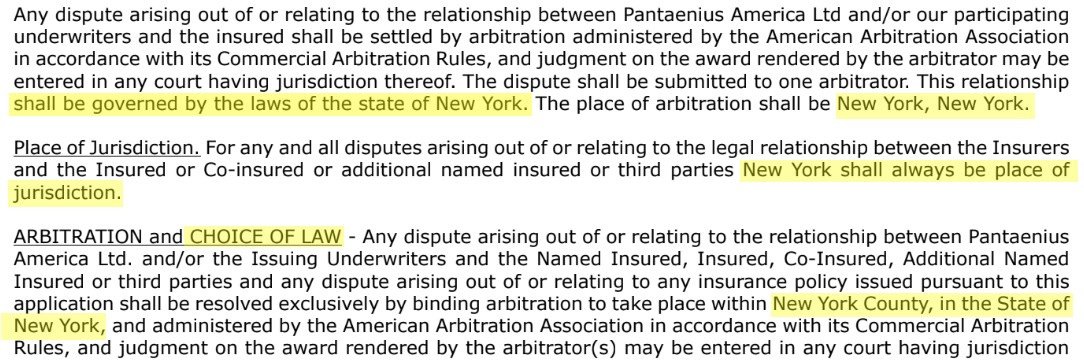

FINE PRINT—This is the kind of language to look for in your policy. It’s the insurance industry’s work-around after the Wilburn Boat decision. Not all policies have this. If yours does, better maker sure you are adhering to all the requirements of your contract.

https://loosecannon.substack.com/p/supreme-court-upholds-back-door-denials

Since there is discussion about insurance I thought this is relevant. I'm guessing we all have been guilty at one time or another of having out of date something on our boats, be it fire extinguishers that still do indeed work or flares. Milk for sure...but to be serious, better check the fire extinguishers now. I have small hand held ones, and half were out of date, so were the flares.

After eating something that made me very ill as a youth, I religiously check food dates, go look in your refrigerator at all the condiments in particular that could even be years old lol, but these things could be sooo much more important. Is there an industry annual check list? Reminder tool for the marine industry? Airplanes have annuals, we hate those but have to have them if you want to stay current. I'm sure that most "captains" on here have a rolling calendar that fire extinguishers and other items that have expiration dates are to be checked and replenished. Do smoke detectors have expiration dates? Co detectors? Etc...It makes no sense at all that an insurance company could denied a claim because something was out of date that had zero effect on the claim.

The U.S. Supreme Court recently upheld a marine insurance company’s right to have claim disputes decided in states whose laws favor the industry over claimants.

The February 21 ruling should send us running to check the fine print in our policies—and maybe the dates on the our fire extinguishers, too.

The case is about a boatowner whose 70-foot motoryacht Raiders was involved in a collision and went aground near Ft. Lauderdale. Phil Pulley filed a claim for the damage, but his insurance company effectively denied the claim because the boat’s fire suppression system was out of compliance under terms of the policy, even though the claim had nothing to do with fire. There was no fire.

Great Lakes Insurance followed a longstanding practice within the industry by declaring Pulley’s policy “void from it’s inception” for non-compliance, then canceled the policy and refunded his premium payments, which amounted to a lot less than what the claim was worth.

Long story short: Pulley took it to court and lost, appealed and won, then his insurance company took the case to the Supreme Court, where Pulley lost forever.

Insurers invoke “breach of warranty” to deny a claim when there is a concurrent but unrelated failure by a policyholder to adhere to the letter of their contract. Breach of warranty is the legal term. Strictly speaking, the case wasn’t about breach of warranty, however.

Great Lakes Insurance v. Raiders Retreat Realty was about “choice of forum.” That is, whether an insurance company can specify that disputes be adjudicated in a state whose laws support the breach-of-warranty denials and make them stick.

Lawyers for Raiders Retreat argued that the deciding laws should be those of Pennsylvania—the boatowner’s home state—because Pennsylvania has a “strong public policy” of not strictly enforcing insurance warranty clauses in claims disputes.

The insurance claim for this motoryacht went all the way to the Supreme Court.

However, the Supreme Court held that choice-of-forum provisions have long been honored under maritime law and enable insurers to better assess risk. “Choice-of-law provisions therefore can lower the price and expand the availability of marine insurance. In those ways, choice-of-law provisions advance a fundamental purpose of federal maritime law: ‘protection of maritime commerce’,” Justice Brett Kavanaugh wrote for the majority.

Cary Wiener is an admiralty lawyer and senior marine advocate for national risk control at Gallagher, a global insurance company. He praised the ruling for preserving an element of predictability in marine insurance.

“Since maritime insurance policies are often provided with large navigational areas, it is essential for both the insurer and insured to know how the wording of the policy will be interpreted based on a provided forum,” Wiener said. “This is especially true since the policies are not subject to state mandated clauses and because of the transient nature of the insured risk.”

Elephant in the Courtroom

Justice Clarence Thomas wrote a concurring opinion that addressed the elephant in the courtroom—the case of Wilburn Boat Company v. Fireman’s Fund Insurance Company, which lawyers simply refer to as “Wilburn Boat.” Wilburn Boat is a 1955 case which threw out the longstanding recognition of warranty clauses in U.S. Maritime Law. Wilburn Boat has been reviled as a destabilizing influence ever since.

The case involved a houseboat destroyed by fire. Fireman’s Fund refused to pay the claim because the boat was being used to carry passengers for hire in violation of one the policy’s express warranty clauses. The high court ruled that Texas law applied, so the policy could not be voided. Fireman’s was forced to pay out.

Reliance on a choice-of-forum clause has been the insurance industry’s work-around so it could continue to enforce warranty clauses—despite Wilburn Boat—in jurisdictions such as New York.

Justice Thomas used Great Lakes v. Raider as a vehicle to heap his own dose of scorn onto Wilburn Boat.

The decision was so bad, Thomas argued, that the court had been retreating from it in subsequent cases ever since, including the current ruling. “Today’s decision further erodes Wilburn Boat’s foundation, and rightly so. In light of these decisions, it is not clear what, if anything, is left of Wilburn Boat’s rationale,” Thomas wrote.

Greg Singer, a lawyer for the Lochner Law Firm of Annapolis, has argued cases in which these distinctions were important. He observed that New York law appears to have been custom crafted to hand marine insurers their advantage.

“Marine insurance companies turn to New York law because while New York insurance law says that an insurance company can’t void a policy for an unrelated breach of warranty, it has a specific carve-out that says the law doesn’t apply to marine insurance policies,” Singer said.

FINE PRINT—This is the kind of language to look for in your policy. It’s the insurance industry’s work-around after the Wilburn Boat decision. Not all policies have this. If yours does, better maker sure you are adhering to all the requirements of your contract.

Attachments

Last edited: