- Joined

- Jan 9, 2014

- Messages

- 4,183

- Location

- USA

- Vessel Name

- N/A

- Vessel Make

- 1999 Mainship 350 Trawler

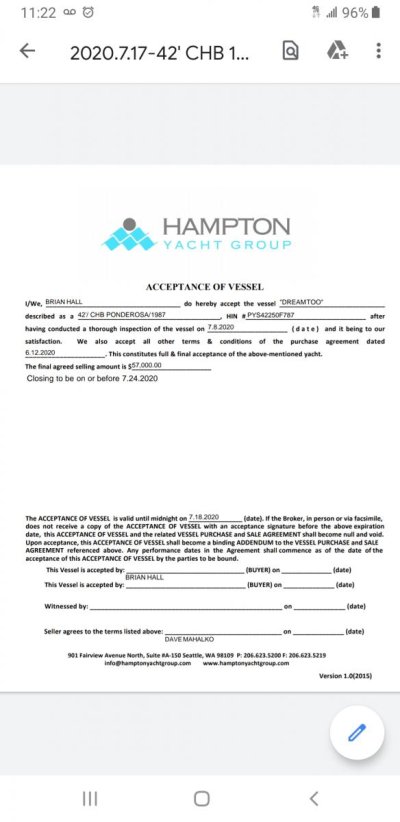

I'm not clear how you (The OP) ended up at this point. Are you verbally negotiating the price?? The P&S should be the offer, signed by you. The acceptance should be the signed P&S from the seller.

It looks like you are verbally negotiating the price and the P&S has been drafted by the broker. You have a P&S (Offer of Acceptance??) with no signatures. You're going to need to finance and pay taxes on the $77K, then get a 'credit' at the time of closing?

I would expect this to read:

Purchase Price: 77K

Credit: $20K

Balance Due at Closing: $57K

This is a promise of a credit which, in itself, is oddly worded.

The brokers commission should not become your tax burden.

It looks like you are verbally negotiating the price and the P&S has been drafted by the broker. You have a P&S (Offer of Acceptance??) with no signatures. You're going to need to finance and pay taxes on the $77K, then get a 'credit' at the time of closing?

I would expect this to read:

Purchase Price: 77K

Credit: $20K

Balance Due at Closing: $57K

This is a promise of a credit which, in itself, is oddly worded.

The brokers commission should not become your tax burden.