You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

diesel prices near me

- Thread starter Swa

- Start date

The friendliest place on the web for anyone who enjoys boating.

If you have answers, please help by responding to the unanswered posts.

If you have answers, please help by responding to the unanswered posts.

NEtrawler58

Senior Member

- Joined

- Mar 7, 2022

- Messages

- 233

Depends on the state. In CT, marine fuels are always exempt from the state sales tax so price at the docks shouldn't be affected, just at the road stations.

Slowmo

Senior Member

- Joined

- Oct 19, 2018

- Messages

- 453

- Location

- United States

- Vessel Name

- Esprit

- Vessel Make

- 40' Tollycraft tricabin diesel

They're planning to release more from the strategic reserve but this is just a temporary thing and doesn't really address the fundamentals which is that US oil production is still about 10% below it's pre-pandemic peak. US oil production essentially doubled between 2010 and 2020 making the US clearly the worlds largest oil producer. Up until January 2020 data suggested production would continue to increase. But between the pandemic and then policy shifts, US production fell at a time world demand returned, causing prices to escalate rapidly. Russia was the #2 producer (after US) in 2021. If Russia were unable to produce oil that would represent 12% of the total world production. Of course Russian oil isn't out of the world market though the number of customers has reduced. However the combined effect of an already tightened market with a reduced US output with the new disruption of Russian oil becoming restricted is a substantial market disruption which will not work out in the near term. My expectation is that higher prices than we see now lie ahead until the market equalizes again. Production will increase but that will take some time and given the uncertainty around Russia we could have high prices for several years.

Hippocampus

Guru

- Joined

- Jul 27, 2020

- Messages

- 3,908

- Location

- Plymouth

- Vessel Name

- Hippocampus

- Vessel Make

- Nordic Tug 42

Question in my mind is when.

Biden’s move to release some reserves is a good thing but oil is a global market so as a %age this action is small. That means it will have little effect in the long run.

Russia has hastened the transition to renewables but that will have no meaningful effect for years and years.

Efficiency standards for mpg were loosened last administration and there’s still a discrepancy between what’s possible and what’s offered. However existing stock on the road isn’t going to be replaced anytime soon. Increased inflation and decreased supply of new vehicles makes this even less likely.

So ultimately one cannot depend upon decreased demand causing fuel costs to come down unless stagnation occurs. Fed has acted appropriately so this hopefully unlikely. Therefore increased production is required.

The wildcards are:

Regime change

China stopping their assistance to Putin.

Saudis (OPEC) opening their supplies

Biden’s move to release some reserves is a good thing but oil is a global market so as a %age this action is small. That means it will have little effect in the long run.

Russia has hastened the transition to renewables but that will have no meaningful effect for years and years.

Efficiency standards for mpg were loosened last administration and there’s still a discrepancy between what’s possible and what’s offered. However existing stock on the road isn’t going to be replaced anytime soon. Increased inflation and decreased supply of new vehicles makes this even less likely.

So ultimately one cannot depend upon decreased demand causing fuel costs to come down unless stagnation occurs. Fed has acted appropriately so this hopefully unlikely. Therefore increased production is required.

The wildcards are:

Regime change

China stopping their assistance to Putin.

Saudis (OPEC) opening their supplies

NEtrawler58

Senior Member

- Joined

- Mar 7, 2022

- Messages

- 233

I don't see any of these temporary measures as a good thing. It's only a Band-Aid that masks the issue and lessens the immediate pain but causes more potential pain in the future. Strategic reserves will need to be replaced eventually at likely much higher prices. Suspending taxes just increases deficits. It's like taking out a high-interest loan to buy a car you really can't afford. Don't get me wrong, I'm all for less taxes and cheaper fuel, but would be happier to see some real long-term solutions. Telling everyone that if they drove electric cars everything would be fine, is not the answer today.

Hippocampus

Guru

- Joined

- Jul 27, 2020

- Messages

- 3,908

- Location

- Plymouth

- Vessel Name

- Hippocampus

- Vessel Make

- Nordic Tug 42

NE spot on��

rslifkin

Guru

- Joined

- Aug 20, 2019

- Messages

- 7,584

- Location

- USA

- Vessel Name

- Hour Glass

- Vessel Make

- Chris Craft 381 Catalina

Suspending fuel taxes is definitely a questionable band-aid. The strategic reserves, maybe, depending on how it's done. If it can cushion things a little to buy time for a production increase, or just cushion the worst demand spikes (and slowly refill during the dips), it'll help. But of course, it can only help so much (not a lot) and isn't a fix for the situation.

lwarden

Guru

The strategic reserve will be sold at higher prices than it will be replenished at most likely. WTI crude closed at just under $100/ BBL on Friday, down from the peak of $123 on March 8th. I would expect oil will settle down around $80 in the coming weeks, especially if China continues locking down and peace talks continue to make some progress.

Releasing the strategic reserves seems symbolic but a good thing. Not sure Biden's chastising the oil companies for exploiting the situation will have any effect, but I think it's a step in the right direction. I would like to see some real reform in controlling the profiteering of companies during a crisis.

Releasing the strategic reserves seems symbolic but a good thing. Not sure Biden's chastising the oil companies for exploiting the situation will have any effect, but I think it's a step in the right direction. I would like to see some real reform in controlling the profiteering of companies during a crisis.

NEtrawler58

Senior Member

- Joined

- Mar 7, 2022

- Messages

- 233

The strategic reserve will be sold at higher prices than it will be replenished at most likely. WTI crude closed at just under $100/ BBL on Friday, down from the peak of $123 on March 8th. I would expect oil will settle down around $80 in the coming weeks, especially if China continues locking down and peace talks continue to make some progress.

Releasing the strategic reserves seems symbolic but a good thing. Not sure Biden's chastising the oil companies for exploiting the situation will have any effect, but I think it's a step in the right direction. I would like to see some real reform in controlling the profiteering of companies during a crisis.

I agree that oil companies should not take advantage of the situation to maximize profits. But I'm not entirely sure I understand how they are doing that. Oil is a global commodity. US companies are not purposely raising the price of crude oil. If they are somehow exploiting the situation then I agree they deserve criticism. However, I don't agree with blaming oil companies for the current situation and making them out to be evil. The current anti-oil sentiment does not encourage investment to increase domestic oil production.

lwarden

Guru

I don't blame the oil companies for the high price of crude, as you state, it is a global commodity. But they do have the ability to increase output and help to keep prices in check.

Have you looked at the 2021 4th quarter profits from the top 10 oil companies? Pretty much says it all. High oil prices have been a bonanza for them. And to make matters worse they are reducing the investment in new wells/equipment and doing more stock buybacks than investing to increase capacity. This won't help with capacity and at a time when customers are hurting they could do their part to keep prices down even if it means more modest profits. I won't hold my breath....

Have you looked at the 2021 4th quarter profits from the top 10 oil companies? Pretty much says it all. High oil prices have been a bonanza for them. And to make matters worse they are reducing the investment in new wells/equipment and doing more stock buybacks than investing to increase capacity. This won't help with capacity and at a time when customers are hurting they could do their part to keep prices down even if it means more modest profits. I won't hold my breath....

SteveK

Guru

- Joined

- Jul 5, 2019

- Messages

- 5,074

- Location

- Gulf Isalnds BC canada

- Vessel Name

- Sea Sanctuary

- Vessel Make

- Bayliner 4588

I won't mention Ganges Marina by name either as the place to get the highest cost fuel.Yesterday, at an unnamed marina in BC's Southern Gulf Islands, the diesel was C$2.559 per litre, which is about US$7.75 per gallon. No matter what happens to world/market oil price, BC will see another increase on 1 April for the annual carbon tax increase.

BruceK

Moderator Emeritus

- Joined

- Oct 31, 2011

- Messages

- 13,347

- Vessel Name

- Sojourn

- Vessel Make

- Integrity 386

Australia imposes a federal 44.2c excise/tax per litre of fuel which was just halved for 6 months to lower current fuel costs and dare I say it,"assist" with the May federal election.Suspending fuel taxes is definitely a questionable band-aid. The strategic reserves, maybe, depending on how it's done. If it can cushion things a little to buy time for a production increase, or just cushion the worst demand spikes (and slowly refill during the dips), it'll help. But of course, it can only help so much (not a lot) and isn't a fix for the situation.

We have an odd phenomenon called a price cycle where fuel prices go sky high and slowly over 2-3 weeks edge down until the cartel members lose their competitive nerve and it rockets back up. Rinse and Repeat.

We also allegedly have a massive emergency reserve store of fuel,held not here but somewhere in USA. Only problem, I don`t think we have access to tankers which could get it here. Especially in a war. Always assuming it actually exists.

Last edited:

NEtrawler58

Senior Member

- Joined

- Mar 7, 2022

- Messages

- 233

I don't blame the oil companies for the high price of crude, as you state, it is a global commodity. But they do have the ability to increase output and help to keep prices in check.

Have you looked at the 2021 4th quarter profits from the top 10 oil companies? Pretty much says it all. High oil prices have been a bonanza for them. And to make matters worse they are reducing the investment in new wells/equipment and doing more stock buybacks than investing to increase capacity. This won't help with capacity and at a time when customers are hurting they could do their part to keep prices down even if it means more modest profits. I won't hold my breath....

As a country, we have the ability to produce more oil, but the current administration is not encouraging that. Instead the oil companies have been demonized. Higher restrictions on drilling and shutting down pipelines does not encourage production. Instead we'd rather import foreign oil which is worse for climate change than if we were to produce it domestically. Makes no sense, but that's not unusual.

Hippocampus

Guru

- Joined

- Jul 27, 2020

- Messages

- 3,908

- Location

- Plymouth

- Vessel Name

- Hippocampus

- Vessel Make

- Nordic Tug 42

Some of this doesn’t account for refining and distribution. Due to prior increase in destructive weather events (MMCC) refining capacities domestically are decreased. Unused refining capacity is limited. Doesn’t matter how much you take out of the ground. What’s matters is how much is refined and ready for use.

At both the regional distributor level and to the endpoint retail seller distribution networks remain subpar. Distortions in trucking from Covid persist. Decline in attractiveness of becoming a trucker predate Covid so hazmat drivers become rarer. This plus long term difficulties in pipeline distribution means increasing availability to end users isn’t comparable to just turning on a faucet.

So there’s several things operative. Price is set globally. Increase in domestic production, refining and distribution has a long latency requiring significant capitalization. Irrespective of any federal actions involved companies are international. They will seek sources where production costs are lowest. They will also factor in a future of less demand as alternative energy sources expand and efficiencies of end users increase. To remain solvent they think in decades. Much of the above posts are in a time frame of weeks or months.

At both the regional distributor level and to the endpoint retail seller distribution networks remain subpar. Distortions in trucking from Covid persist. Decline in attractiveness of becoming a trucker predate Covid so hazmat drivers become rarer. This plus long term difficulties in pipeline distribution means increasing availability to end users isn’t comparable to just turning on a faucet.

So there’s several things operative. Price is set globally. Increase in domestic production, refining and distribution has a long latency requiring significant capitalization. Irrespective of any federal actions involved companies are international. They will seek sources where production costs are lowest. They will also factor in a future of less demand as alternative energy sources expand and efficiencies of end users increase. To remain solvent they think in decades. Much of the above posts are in a time frame of weeks or months.

rslifkin

Guru

- Joined

- Aug 20, 2019

- Messages

- 7,584

- Location

- USA

- Vessel Name

- Hour Glass

- Vessel Make

- Chris Craft 381 Catalina

We also allegedly have a massive emergency reserve store of fuel,held not here but somewhere in USA. Only problem, I don`t think we have access to tankers which could get it here. Especially in a war. Always assuming it actually exists.

Even if you couldn't directly get the oil to Australia, it could still be sold or traded to obtain oil from somewhere that you can actually get it from.

NEtrawler58

Senior Member

- Joined

- Mar 7, 2022

- Messages

- 233

I agree with Hippo that you can't just open the faucet, it takes a long time to ramp up production. Still, it's a little puzzling why it's so difficult to get back to the levels we were at a few years ago. Production is down significantly from the peak in 2019. I try not to believe the political rhetoric on either side, because neither is telling the whole truth. I do however believe that policy and also the demonizing of big oil has an impact. It's also interesting to learn that in some years oil companies operated at a pretty big loss, but only the record profits make the news. I found this article to be pretty balanced in describing the current situation.

https://www.forbes.com/sites/rrapie...lding-back-us-oil-production/?sh=3afcff936b6f

https://www.forbes.com/sites/rrapie...lding-back-us-oil-production/?sh=3afcff936b6f

Benthic2

Guru

lwarden;1089945.... And to make matters worse they are reducing the investment in new wells/equipment and doing more stock buybacks than investing to increase capacity.....[/QUOTE said:I firmly believe in free market economics and every company's right to self determination...HOWEVER, if a company chooses to do a stock buy back, they should be ineligible for any government subsidies, tax breaks or incentive.

O C Diver

Guru

- Joined

- Dec 16, 2010

- Messages

- 12,867

- Location

- USA

- Vessel Name

- Slow Hand

- Vessel Make

- Cherubini Independence 45

A new sign of the times. You see a good price on diesel, and you pump Their tank dry. Indian Town Marina was $4.50 a gallon after tax. 335 gallons later, they were out.  I could probably haved squeezed another 60 gallons in, but no point in complaining.

I could probably haved squeezed another 60 gallons in, but no point in complaining.

Ted

Ted

Last edited:

- Joined

- May 11, 2019

- Messages

- 3,438

- Location

- United States

- Vessel Name

- Muirgen

- Vessel Make

- 50' Beebe Passagemaker

A new sign of the times. You see a good price on diesel, and you pump Their tank dry. Indian Town Marina was $4.50 a gallon after tax. 335 gallons later, they were out.I could probably haved squeezed another 60 gallons in, but no point in complaining.

Ted

I wouldn't have wanted to put that last 50 gallons of. . . . whatever into my boat. Hopefully it was all clean fuel!

NEtrawler58

Senior Member

- Joined

- Mar 7, 2022

- Messages

- 233

I wouldn't have wanted to put that last 50 gallons of. . . . whatever into my boat. Hopefully it was all clean fuel!

I agree, and perhaps the reason it was cheap is they haven't purchased new fuel in a few months.

Hippocampus

Guru

- Joined

- Jul 27, 2020

- Messages

- 3,908

- Location

- Plymouth

- Vessel Name

- Hippocampus

- Vessel Make

- Nordic Tug 42

Personally try to not buy fuel the first or second day from delivery nor when close to empty. I usually ask by phone when last delivery occurred. Last boat had 4 fuels tanks. We filled at Blue water Hampton just before leaving on passage to BVI. One tank was empty and another half full before fill. The other two ~80%. In Sargasso Sea there was no wind so powered. Went through 6 racors with the tank that needed a complete fill. It didn’t seem to be clearing so stopped using it. The other 1/2 full tank to start took another 6 racors but cleared. After that experience have become totally anal about wanting to know when d fuel deliveries occur. Bluewater usually has excellent fuel and would have no reluctance to getting fuel there. The Salty Dawg left from there. Think with ~100boats filling up or topping off they were drawing from the bottom and things were stirred up. Up north from good yards think you can also get into trouble for similar reasons. So try to buy fuel mid week 2-3 days after a delivery. Found putting fuel in a clear glass or plastic container and looking at it can be misleading. Found baha filters of questionable help.

mvweebles

Guru

- Joined

- Mar 21, 2019

- Messages

- 7,222

- Location

- United States

- Vessel Name

- Weebles

- Vessel Make

- 1970 Willard 36 Trawler

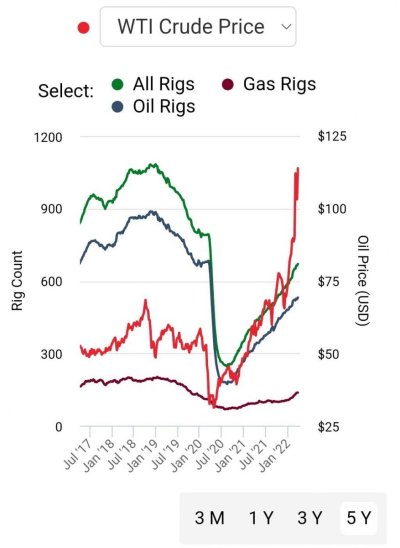

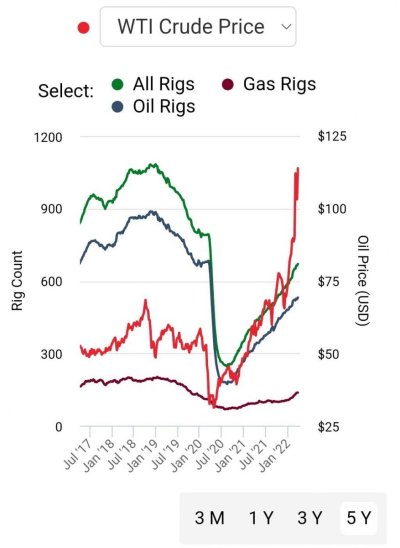

Oil industry is extremely complex. I have worked for one of the integrated global majors since 2013, recently one of their upstream (exploration and extraction) business units but have done work in midstream and downstream (transportation, storage, and refining). An industry benchmark view of health and condition is rig count. See this graph (US rigs) from one of the industry watch groups - ramping up production takes time. The huge cliff-drop in pandemic corresponds to a period where oil hit -$37/bbl meanng producers had to pay to get rid of oil because all storage was full and there was no place to put it. It's easy to turn-off operations - you just cancel contracts. Ramping-up is a much, much different matter - think of it this way: my neighborhood has many older homes being razed for a new McMansion. Takes about 4-days to level a house. Takes a year and a half to build a new one. But as you can see production is ramping pretty quickly.

Most of the majors are profitable at around $35-$40 bbl, but they feather their wells - reducing or idling expensive ones when pricing is low.

This is normal business practice that we'd all do.

Most of the majors are profitable at around $35-$40 bbl, but they feather their wells - reducing or idling expensive ones when pricing is low.

This is normal business practice that we'd all do.

Last edited:

O C Diver

Guru

- Joined

- Dec 16, 2010

- Messages

- 12,867

- Location

- USA

- Vessel Name

- Slow Hand

- Vessel Make

- Cherubini Independence 45

I wouldn't have wanted to put that last 50 gallons of. . . . whatever into my boat. Hopefully it was all clean fuel!

They have an above ground tank, and the pump is shutoff by a float switch. No worries, yet.

Ted

O C Diver

Guru

- Joined

- Dec 16, 2010

- Messages

- 12,867

- Location

- USA

- Vessel Name

- Slow Hand

- Vessel Make

- Cherubini Independence 45

I fill to my port tank and polish / transfer / use from starboard. Simply, I assume all fuel I buy is bad. Usually I'm pleasantly surprised. If you cruise, it would be foolish to assume otherwise. BTW, when was the last time a marina told you upfront that they have bad fuel. They very well may not know, so assume the worst and be prepared.

Ted

Ted

Found putting fuel in a clear glass or plastic container and looking at it can be misleading..

But we've found using a test kit to be useful. Far better than timing the market.

Hippocampus

Guru

- Joined

- Jul 27, 2020

- Messages

- 3,908

- Location

- Plymouth

- Vessel Name

- Hippocampus

- Vessel Make

- Nordic Tug 42

Once again not 100% but definitely better than just looking at it.

twistedtree

Guru

Just fueled at Covich-Williams in Seattle. $4.25 per gallon for 1000 gal and paying by check. That’s down about $.50 per gal since last week. Still expensive, but much better than over $5.

rslifkin

Guru

- Joined

- Aug 20, 2019

- Messages

- 7,584

- Location

- USA

- Vessel Name

- Hour Glass

- Vessel Make

- Chris Craft 381 Catalina

We put 200 gallons of gas in the boat yesterday at $5.54 / gal. I didn't fill the tanks hoping that prices come down a bit (or we go somewhere with cheaper fuel) before we need more.

Sailor of Fortune

Guru

Sunday 3/27 took 115,000 gallons of diesel in the tug...at $4.38/gallon. We ordered 160,000 gallons but the barge showed up 4.5 hrs late and we had to scoot... Glad I wasn't paying for it. We loaded 115,000 gallons in 3.5 hrs. Much faster than fuel docks.Usually 15k and hr at fuel dock

Similar threads

- Replies

- 3

- Views

- 464

- Replies

- 29

- Views

- 3K