I recently bought a Documented boat in Maine and recently brought it to Vermont which is my home base. I could continue with it’s Documented status but, as I understand it, I would still need to pay Sales tax in VT and have a VT registration. Anyone one know if my understanding is correct?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Documented boats in Vermont?

- Thread starter Blues

- Start date

The friendliest place on the web for anyone who enjoys boating.

If you have answers, please help by responding to the unanswered posts.

If you have answers, please help by responding to the unanswered posts.

Comodave

Moderator Emeritus

- Joined

- Jul 2, 2015

- Messages

- 21,280

- Location

- Au Gres, MI

- Vessel Name

- Black Dog

- Vessel Make

- Formula 41PC

I recently bought a Documented boat in Maine and recently brought it to Vermont which is my home base. I could continue with it’s Documented status but, as I understand it, I would still need to pay Sales tax in VT and have a VT registration. Anyone one know if my understanding is correct?

Most likely you will need to register it and pay sales tax in Vermont. But I am not familiar with Vermont laws so I would check with the agency that registers boats in Vermont.

ranger58sb

Guru

I recently bought a Documented boat in Maine and recently brought it to Vermont which is my home base. I could continue with it’s Documented status but, as I understand it, I would still need to pay Sales tax in VT and have a VT registration. Anyone one know if my understanding is correct?

Dunno about Vermont, but...

Sales tax is a whole separate issue from whether to remain documented or to instead get a state title.

"Registration" may be something simple. Here where we are, documented boats are also "registered" in a way. That is, we must pay a nominal fee to get a sticker that says we're a documented boat and MD knows about it. Not connected to a titling process, given we're documented.

Here, a state title for boats includes a similar sticker... and registration numbers on the hull.

-Chris

CharlieO.

Guru

- Joined

- Sep 21, 2020

- Messages

- 1,551

- Location

- Lake Champlain Vermont, USA

- Vessel Name

- Luna C.

- Vessel Make

- 1977 Marine Trader 34DC

twistedtree

Guru

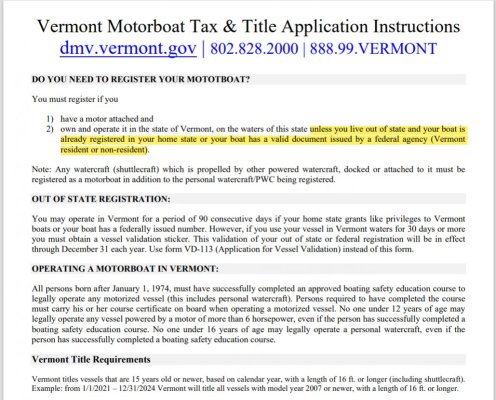

I interpret this as no on the registration requirement.

Not sure how you'd pay the sale tax, usually you pay that when you register and or title it.

Edit: could probably be interpreted either way?

I’m a Vermont resident and my read is the same as yours. Documented boats do not get separately state registered. Your documentation meets state’s requirements.

I’m not sure about paying sales or use tax, and whether it’s even due on a boat purchased out of state. My boat has not been in Vermont, so no taxes triggered so I haven’t investigated further. Please let me know what you find.

Careful as there is a difference between being registered and being validated in VT

Not needing to register doesn't mean no need to do anything beyond documentation. Vessels in VT

"Vessels documented by the USCG or registered legally in another state or country must validate their registration numbers by obtaining a validation sticker from the Vermont Department of Motor Vehicles (DMV) if the vessels are on Vermont waters for at least 60 days in a calendar year."

"What Do I Need to Obtain a Validation Sticker?

Application for vessel validation.

2. Proof of valid registration or documentation from another state or province.

3. Vermont Sales & Use Tax Return or proof that Vermont Sales and Use Tax has been paid, or proof of tax paid in another state.

4. Proper "

Not needing to register doesn't mean no need to do anything beyond documentation. Vessels in VT

"Vessels documented by the USCG or registered legally in another state or country must validate their registration numbers by obtaining a validation sticker from the Vermont Department of Motor Vehicles (DMV) if the vessels are on Vermont waters for at least 60 days in a calendar year."

"What Do I Need to Obtain a Validation Sticker?

Application for vessel validation.

2. Proof of valid registration or documentation from another state or province.

3. Vermont Sales & Use Tax Return or proof that Vermont Sales and Use Tax has been paid, or proof of tax paid in another state.

4. Proper "

twistedtree

Guru

Careful as there is a difference between being registered and being validated in VT

Not needing to register doesn't mean no need to do anything beyond documentation. Vessels in VT

"Vessels documented by the USCG or registered legally in another state or country must validate their registration numbers by obtaining a validation sticker from the Vermont Department of Motor Vehicles (DMV) if the vessels are on Vermont waters for at least 60 days in a calendar year."

"What Do I Need to Obtain a Validation Sticker?

Application for vessel validation.

2. Proof of valid registration or documentation from another state or province.

3. Vermont Sales & Use Tax Return or proof that Vermont Sales and Use Tax has been paid, or proof of tax paid in another state.

4. Proper "

OK, so that's the mechanism to collect use tax when the boat is brought into VT. Good to know - thanks.

Comodave

Moderator Emeritus

- Joined

- Jul 2, 2015

- Messages

- 21,280

- Location

- Au Gres, MI

- Vessel Name

- Black Dog

- Vessel Make

- Formula 41PC

Michigan will get you if you have a boat that is documented but not registered in a state if you are in Michigan too long. Not sure what the limit is but worth being careful. They want the registration fees and the sales tax.

jgwinks

Guru

Michigan will get you if you have a boat that is documented but not registered in a state if you are in Michigan too long. Not sure what the limit is but worth being careful. They want the registration fees and the sales tax.

As well any other state that registers Documented vessels. There are a few that don't.

Blues

Veteran Member

- Joined

- Aug 19, 2021

- Messages

- 43

- Vessel Name

- Fish Camp

- Vessel Make

- Eagle 32

Careful as there is a difference between being registered and being validated in VT

Not needing to register doesn't mean no need to do anything beyond documentation. Vessels in VT

"Vessels documented by the USCG or registered legally in another state or country must validate their registration numbers by obtaining a validation sticker from the Vermont Department of Motor Vehicles (DMV) if the vessels are on Vermont waters for at least 60 days in a calendar year."

"What Do I Need to Obtain a Validation Sticker?

Application for vessel validation.

2. Proof of valid registration or documentation from another state or province.

3. Vermont Sales & Use Tax Return or proof that Vermont Sales and Use Tax has been paid, or proof of tax paid in another state.

4. Proper "

What are the rules in New York which is a mere 10 miles away?

Documented boats in NY require registration. Only difference is NY doesnt issue NY Reg #s they just collect any sales tax, issue a sticker and collect the Registration $. I have to display the Reg sticker but no #s. That is similar to many but not all ststes.

jgwinks

Guru

Documented boats in NY require registration. Only difference is NYbdoesnt N issue NY Reg #s they just collect any sales tax, issue a sticker and collect the Registration $. I hacebto display the Reg sticker but no #s. That is similar to many but not all ststes.

Actually it's illegal to display state numbers on a Documented boat so no state requires it. They may issue numbers (Michigan does) but you don't display them. You do display the tax stickers if your state issues them.

Similar threads

- Replies

- 36

- Views

- 4K

- Replies

- 13

- Views

- 1K

- Replies

- 60

- Views

- 8K