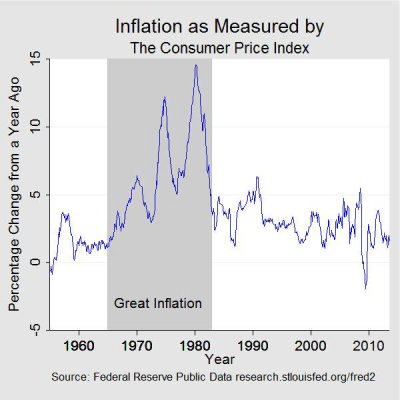

I'm no PhD in economics, but I used to think I had a general sense of how things tend to work and flow. Not anymore. In a separate thread -- on the pretty shocking escalation in fuel prices -- I mentioned how they're rolling out the 2023 Cadillac Escalade for $149,000, and doubtless terrible fuel mileage. Meanwhile I keep wondering how lower income families are paying $5 for gas, and $5 for milk (in some places). But boat and RV prices haven't declined as far as I can tell. Interest rates are climbing, but houses are still ridiculously expensive....

Some people have money and can by the Escalade. Some people don't have money and will struggle to pay for the $5 gas, milk, pork chops, etc. Nothing new in this but inflation just makes it all worse.

I read more European based news sites than ones in the US. Before Putin's War, inflation was on the rise and hurting people. Putin's War accelerated and made inflation worse and I think it will get worse due to higher energy and food costs.

Since many western industrial nations are moving away from a diversity of energy sources that can provide continuous power production, to a single source, i.e., natural gas, prices for power are rising, will continue to rise, and there will be black outs. It is expected that part of New York will have black outs this summer if the temperature gets into the high 90s due to lack of power generation.

From a Wall Street Journal report:

Midcontinent Independent System Operator, or MISO, which oversees a large regional grid spanning from Louisiana to Manitoba, Canada, coal- and gas-fired power plants supplying more than 13 gigawatts of power are expected to close by 2024 as a result of economic pressures, as well as efforts by some utilities to shift more quickly to renewables to address climate change. Meanwhile, only 8 gigawatts of replacement supplies are under development in the area.

Me thinks those states have a problem. In the UK and Ireland they are already ahead of us. Last winter, due to high energy costs, people on fixed budgets were having to decide to stay warm or have something to eat.

Apparently, energy prices to homes is capped at some level in the UK. Companies can only raise prices to that cap and no more unless the government changes the numbers. If the COST of power production rises to a point of being unprofitable, there is nothing the company can do but go out of business. The last number I saw, was that somewhere around 15-20 energy companies had gone out of business. This was due to the increase in natural gas prices. Everyone needs natural gas to produce power when renewables are not working, which was a problem months ago.

This caused an interesting food supply and cost issues in the UK. I knew that natural gas is used to product fertilizer. In the UK they have two plants that product fertilizer from natural gas AND produce CO2.

CO2 is used in a variety of food production but what I did not know, was that they use CO2 to slaughter live stock. No CO2 and no chick, pork, or beef.

Because of the cost of natural gas, the two plants producing fertilizer and CO2 shut down. Eventually, the UK government stepped in to help pay for natural gas, otherwise they would have a huge food supply disaster.

The head of the Green party in Ireland is the head of the Ministry of Environment and he has proposed a ban on peat burning in September. This has caused a firestorm since at least 30% of the rural population still used peat to warm their homes. The minister wants to ban all use of solid fuel for warming houses, including wood burning, which many homes require to keep from freezing.

If you want to control many Western countries, control the supply of natural gas. This has been made possible because of the move from a diversity of continuous power production energy sources to a dependency of natural gas to provide power when renewables are not working.

Later,

Dan

CO2 is used in a variety of food production but what I did not know, was that they use CO2 to slaughter live stock. No CO2 and no chick, pork, or beef.

CO2 is used in a variety of food production but what I did not know, was that they use CO2 to slaughter live stock. No CO2 and no chick, pork, or beef.