Alaskan Sea-Duction

Guru

- Joined

- Jul 6, 2012

- Messages

- 8,058

- Location

- USA

- Vessel Name

- Alaskan Sea-Duction

- Vessel Make

- 1988 M/Y Camargue YachtFisher

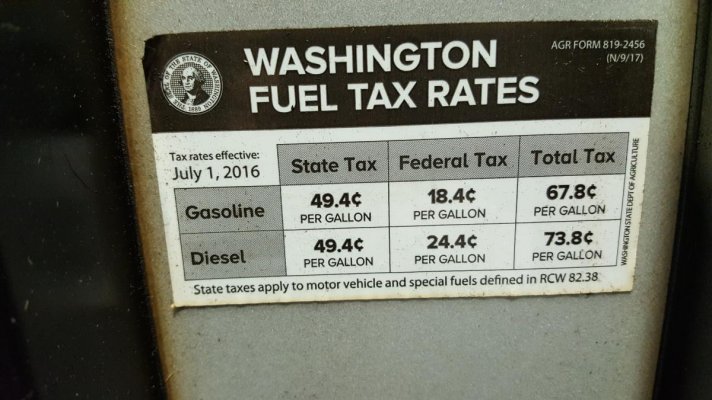

This is getting crazy. Tax ASD as I pass Astoria? Toll shipping channel?

https://www.dailyastorian.com/news/...cle_8a4e9956-03b7-11e9-bd98-0337f0c45339.html

https://www.dailyastorian.com/news/...cle_8a4e9956-03b7-11e9-bd98-0337f0c45339.html