Interesting thread. I am in the insurance industry and gave a seminar on marine insurance to our yacht club a couple of years go. I reviewed policies from six different companies and there were significant differences between all of them. If you have a boat that is kept in the water (I.e. Not on a trailer) you should get quotes and coverage comparisons from a good yacht broker.

For those who have posted that they knowingly traveled outside their coverage zones... what a bad idea. Imagine an accident where you couldn't limp back. Engine failure, boat is grounded on rocks. You get nothing. Or someone is injured on your boat. No coverage from the boat policy, then your Umbrella ( you have one, right?) policy won't kick in.

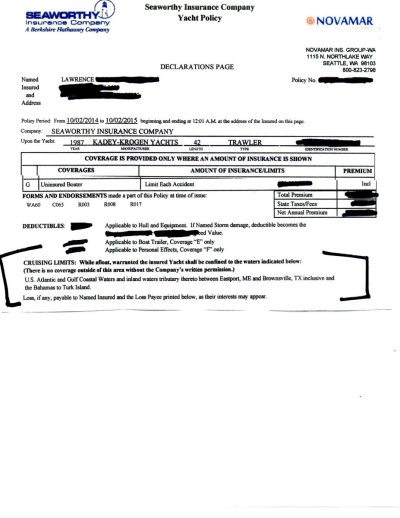

In a significant claim I could see an insurer look at your GPS tracks or other information in order to determine whether they would cover you. You could end up (single or double) screwed. Boat insurance is NOT like car insurance. Work with one of the brokers mentioned in this thread and get the right coverage for all of your needs.

He put it so clearly and we keep saying it but I'm still not sure how many listening. If you don't know every detail of your policy then you have no idea if it's a good price or not. Every inclusion and every exclusion.

You circumvent the policy and it can so easily backfire on you. Insurers are happy to let you go your own way until you have a claim. But they do investigate claims, especially sizable ones. And they know every trick, everything to look for.

Don't ignore the hint on umbrella policies. Now as he said it won't help if you're outside the boundaries of your primary coverage. But most people don't realize how much umbrella coverage you can get for a modest amount. I don't care how much your primary policies cover, it's still very easy to get sued for many times those amounts.

I'd say 95% of insurance agents know little to nothing about marine insurance. And of those who do know, 95% of them know nothing about coastal or ocean coverage. You even go to these insurers like Boat US and you're getting what someone sees on their system which may or may not be what you need. Most of the persons you get do not know the intricacies. Ask them a couple of complicated questions and you'll find out. For instance, if the salvage is secondary to a non covered event, will it pay for the salvage? (Example, salvage the result of an engine failure covered under engine warranty). What about environmental resulting from causes other than collision? What about named storm, are there any requirements on where or how the boat must be secured? What about a storm in which my boat isn't directly damaged but is damaged by another uninsured boat?

I won't buy any policy that I haven't seen the full policy first. The first pages I turn to are the exclusions. I've read every policy I have in full just as I read manuals for equipment. Sick, I know. But I've also had them reviewed by others who know more about them than I do.

Auto insurance policies are carefully regulated by every state and still many have totally inadequate policies. This brings us back to umbrella. There's a common statement I've heard by auto agents that says there is no reason to insure for more than your net worth. It has zero logic. People can make claims against you far beyond your net worth. There are a lot of companies and individuals who end up having to declare bankruptcy after one major claim.

How many people have thought they had great coverage on their homes for hurricanes, but found out not for the flooding? How many had the roof blown off and covered but not the rain through the open hole?

Incidental damage is major with warranty's and insurance. Many boat policies do not cover anything that happens incidentally to a non-covered event.

In business, we prefer fancy words so we have someone to head our Risk Management department. Well, that's what insurance is, risk management. And if you don't personally have someone to manage that, then you better be sure those you use outside such as brokers or lawyers or any others are doing it for you. Rest assured the insurer has their own risk management people to manage their risks. Do you have a broker you trust to manage yours or just a broker or agent collecting commissions from insurers?

I'm going to say this too. Yacht insurance. I don't generally like to use the word "Yacht". But there are companies that have yacht insurance as opposed to "boat" insurance. That word scares people away. You think, I don't have a yacht so I sure can't afford yacht insurance. You'll be amazed how wrong you are. Go through a true marine broker and you'll probably find out that for equal coverage...not I said EQUAL COVERAGE...the so-called Yacht insurance is less expensive than the so-called boat insurance. Major marine insurers don't charge an arm and a leg to cover you in the Bahamas or South Florida or other places. The majority of their customers go to those areas. I have to laugh at how many times I've heard people say we can't get coverage that will allow us south of certain lines during hurricane season. I ask them, "Do you think no boats in Florida are insured?" Right there they should know they need a different broker for their marine insurance, because the true story is their agent doesn't have a policy or know how to get one to cover them in those areas.

Please carefully shop your broker, then carefully shop your policy. What you don't know can cost you everything.