firstbase

Guru

- Joined

- Nov 6, 2016

- Messages

- 1,644

- Location

- United States

- Vessel Name

- Black Eyed Susan

- Vessel Make

- Grand Banks 42' Classic

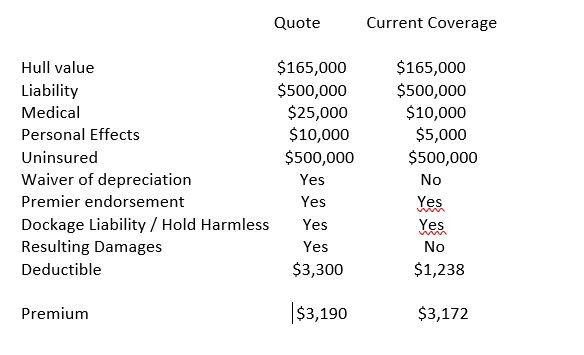

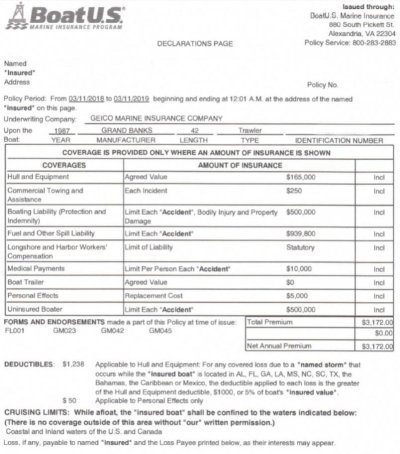

Looking at a change in my boat insurance. Got a quote and comparing to what I have now. Both are through Geico. I may be nit picking, not sure. Biggest differences are the addition of Resulting Damages coverage, Waiver of Depreciation. Slightly higher coverage on Medical and Personal Effects. Deductible is higher due to current policy credits for no claims. One thing I should consider is that this is a new, current quote and my current coverage is due for renewal in March. It may increase as other Geico customers are showing online and the $$$ delta between the two will increase.

Any comments on which is best? Is this a no brainer?

Any comments on which is best? Is this a no brainer?

Attachments

Last edited: