While some don't pay who should, the vast majority don't pay because they lack the necessary income. Look at all those living on social security alone. They don't pay. Would you suggest they should then pay income taxes on their social security. Look at the 15% living below the poverty line, the 30% in near poverty and the 40+% that are below 2 x the poverty line, still below a subsistence level. As someone else pointed out, even those not paying Federal Income Tax are paying 7.65% in federal taxes plus several percent in state taxes through sales tax so their tax rate is in excess of 10%.

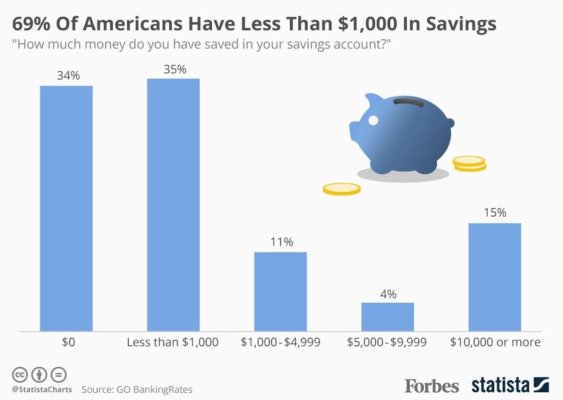

If you pay taxes as a retiree, be grateful that you have income other than just social security because many don't. In fact, for 43% of single retirees, social security is 90% or more of their income. The average social security is under $1400 per month and that's before deducting for medicare payment and before any medical costs. If you're not facing these issues be thankful. If you can afford a boat, be thankful. If you have income over $1400 per month be thankful.

Personally, I got a huge tax cut for 2018 and I think that is the most insane thing in the world. Even after charitable donations I paid at a rate of 35% in 2017 and I have no issue with that. I'd pay more if it meant we'd take better care of our poor, our elderly, and our children. I'll pay about 28% in 2018. Did I merit a tax cut? No. However, we will not keep that 7% for ourselves but try to use it to help others. To us, it's dirty money, like that received from some illegal enterprise. Far more tainted than our winnings playing poker a week ago (yes we do pay taxes on those too).

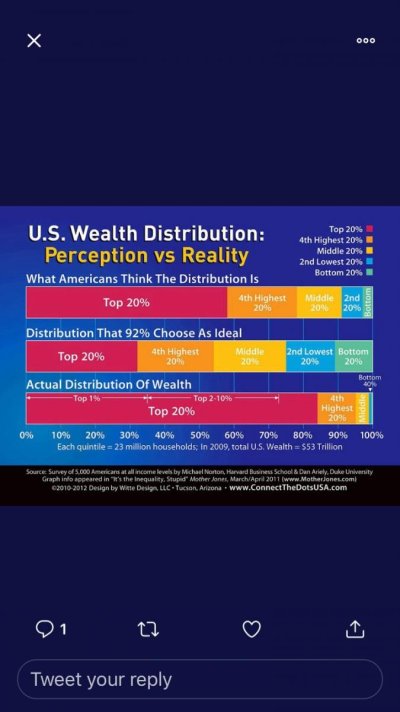

There is a great divide in this country between wealthy and poor with an ever increasing number of both and a shrinking middle class. I see references to the 1% often on this site, but really let's reference the 50%. 99% of the people on this site are among the lucky 50%. Those who have income, who own property or boats or both. Those who can get medical care, can afford food, housing, medication. If you're not aware how many people struggle on a daily basis just to survive, you really need to get out and meet some of them. If you measure the condition of the country by the stock market, then you're excluding the nearly 50% of all Americans who own no stock, no 401-K, no retirement fund, no IRA, no mutual fund, no pension, no ETF. And if for one moment, you think it's because you're better than them or more deserving than them, then there's nothing that I can say that will ever make you more compassionate.

I see the reports of the movie stars who have lost homes in California. I don't worry about them. It's all those we'll never hear of who have lost everything in the Wildfires and in the hurricanes. I recently went to the area of SC and NC ravaged by Florence and took some young executives with me. We went to some of the poorest areas where we've recently purchased manufacturing facilities and the one comment that rang so loud at night was "I can't believe the conditions they live in." We've made sure all those in our extended family actually know personally some others far less fortunate than them.

None of us like how all our tax dollars are used although we'd argue which uses are bad. However, with those suffering in our country, I find it repulsive that I and other wealthy received a tax cut. I do believe a society should be judged not on how those best off in it live but on how it treats the least fortunate among themselves. Based on that, I still believe our society gets a very poor grade.